Introduction to Genetic Testing and Life Insurance

Genetic testing is a medical process that analyzes an individual’s DNA to identify genetic variations or mutations that may indicate a predisposition to certain health conditions. The primary purpose of genetic testing is to provide individuals with essential information that can guide their healthcare decisions, inform family planning, and enhance their overall well-being. This medical advancement has implications not only for personal health but also for various sectors, including life insurance.

Life insurance is a financial product designed to provide monetary compensation to beneficiaries upon the death of the insured. Policy premiums, which are the amounts paid by policyholders for coverage, are typically determined through a comprehensive risk assessment process. Insurers evaluate numerous factors, including an applicant’s age, health status, lifestyle choices, and, increasingly, genetic information. The integration of genetic testing into the underwriting process presents a dual-edged sword in the life insurance landscape.

The intersection of genetic testing and life insurance raises significant ethical and privacy concerns. As insurers begin to consider genetic data as part of their risk evaluation processes, questions arise regarding the privacy of individuals whose genetic information may reveal predispositions to serious medical conditions. Insurers may potentially use this information to influence premium rates, leading to a scenario where individuals with genetic predispositions may face higher premiums or even denial of coverage. This dynamic makes the discussion around genetic testing and life insurance particularly relevant and urgent, as it challenges the traditional notions of privacy and fairness in the context of insurance underwriting.

Understanding these factors is critical in addressing the implications associated with the utilization of genetic testing in life insurance. As this practice evolves, it remains imperative for stakeholders to navigate the balance between the benefits of personalized risk assessment and the ethical considerations that underpin this sensitive issue.

Understanding Genetic Testing

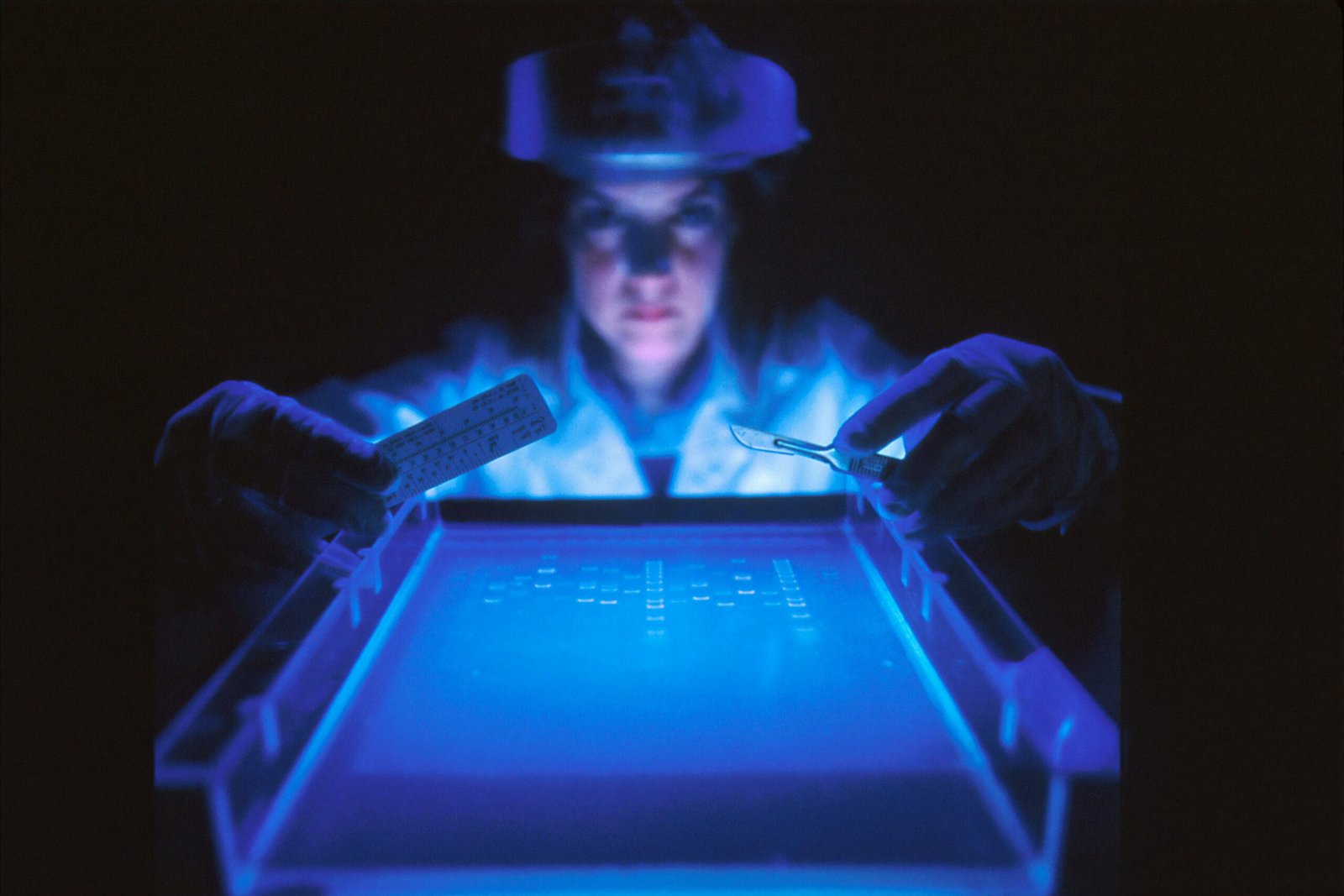

Genetic testing involves analyzing an individual’s DNA to identify specific variations or mutations that might indicate a predisposition to certain health conditions. The primary aim of these tests is to enhance knowledge regarding one’s health risks and inform personal medical management. There are several types of genetic tests available, including diagnostic tests, predictive tests, carrier tests, and prenatal tests, each serving distinct purposes.

Diagnostic tests are employed when an individual exhibits symptoms of a genetic disorder. These tests can confirm the presence of a known condition. Predictive tests, on the other hand, assess the likelihood that an individual will develop a genetic disorder in the future, offering significant insights especially to those with a family history of certain diseases. Carrier tests are used to determine if an individual carries a gene mutation linked to a genetic disorder, which is crucial for couples planning to have children. Prenatal tests analyze the genetic makeup of a fetus to identify potential genetic disorders even before birth.

The process of genetic testing typically involves a simple sample collection, often through blood or saliva. This sample is then sent to a laboratory where it undergoes detailed analysis. The information obtained can range from risk assessments for inherited diseases such as cystic fibrosis or Huntington’s disease to insights about how one might respond to particular medications. The implications of this information are profound, as it allows individuals to make informed decisions concerning their health management strategies.

As genetic testing evolves, it raises questions about privacy and the use of this sensitive information, particularly concerning life insurance. The insights gained through genetic testing can influence life insurance premiums, as insurers may use this data to ascertain risk levels associated with applicants. Understanding the balance between personal privacy and the financial implications of premium adjustments remains a critical discourse in the field of genetics and insurance.

The Role of Genetic Information in Life Insurance

The integration of genetic testing into life insurance underwriting has emerged as a topic of significant interest within the insurance industry. Insurers increasingly rely on genetic data to evaluate potential policyholders’ risk exposure. By analyzing an individual’s genetic predisposition to certain diseases or health conditions, life insurance companies can make more informed decisions about coverage options and associated premiums.

Typically, insurers may consider genetic markers linked to hereditary conditions, such as certain types of cancers, heart diseases, or other chronic illnesses. Individuals with genetic predispositions to these diseases may face higher premiums due to the perceived increased risk. Consequently, this practice raises pressing questions about the balance between necessary risk assessment and the potential infringement on personal privacy. The disclosure of genetic information can lead to the reconsideration of insurance coverage, with some applicants facing possible denial.

Moreover, the implications of genetic information extend beyond individual policies, affecting broader underwriting practices. Insurers must navigate complex regulatory environments to ensure compliance while incorporating genetic testing data. Some jurisdictions have enacted laws limiting the use of genetic information in underwriting to safeguard privacy and avoid discrimination. As such, while genetic testing can enhance a company’s ability to price policies accurately, the ethical considerations surrounding its application cannot be overlooked.

The evolution of genetic testing in life insurance highlights the ongoing tension between privacy and the necessity of premium evaluation. Insurers must carefully consider how they utilize this information while maintaining fair access to coverage for all applicants. As the landscape of genetic testing continues to evolve, so too will the dialog surrounding its role in life insurance, indicating the need for continuous assessment of policies related to underwriting practices in the context of genetic predisposition.

Privacy Concerns Regarding Genetic Testing

As the field of genetic testing continues to advance, it raises significant privacy concerns that individuals must navigate especially in the context of life insurance policies. With the power of genetic testing comes the potential for misuse of personal health information. Insurers may access genetic information to ascertain risk profiles, which can significantly influence an individual’s premiums. This practice has led to apprehensions regarding the ownership of genetic data and who retains control over it.

When individuals undergo genetic testing, the results are inherently sensitive and personal. The question of data security becomes critical; inappropriate access or breaches could lead to unauthorized use of this information by third parties, such as life insurers. If an insurer were to obtain genetic information without proper consent, it could lead to unjust discrimination against individuals based on their predispositions to certain health conditions. Thus, transparency in how genetic data is stored, shared, and utilized is paramount.

Informed consent plays a vital role in alleviating some of these privacy concerns. Individuals must fully understand the implications of sharing their genetic information before consenting to genetic testing. The regulations surrounding genetic data vary widely between regions, leading to a patchwork of protections. In some areas, stringent laws are in place to protect this personal data, while in others, the legal framework may offer minimal safeguards. Therefore, it is imperative for individuals to educate themselves about the legal landscape governing genetic testing and life insurance in their jurisdiction to ensure their privacy is adequately protected.

The intersection of genetic testing and life insurance involves not just concerns over privacy but also raises ethical questions about equity and fairness. Striking a balance between maintaining privacy and determining equitable premiums remains a critical challenge in this evolving field.

Legal Protections for Genetic Information

The legal framework surrounding genetic testing and life insurance has evolved significantly in recent years, mainly due to concerns about discrimination arising from genetic information. A cornerstone of these protections in the United States is the Genetic Information Nondiscrimination Act (GINA), enacted in 2008. GINA prohibits discrimination in health insurance and employment based on an individual’s genetic information, safeguarding individuals from being denied coverage or employment opportunities due to their genetic predispositions.

While GINA provides essential protections, it notably excludes life insurance, long-term care insurance, and disability insurance. This gap raises concerns regarding the extent to which individuals’ genetic information may be used against them in the context of life insurance premium calculations. Insurers may still request and consider genetic test results when assessing risk, potentially leading to higher premiums or outright denial of coverage for those with predisposed conditions. This situation creates a stark dilemma: while genetic testing can inform individuals about their health and risks, it can also lead to financial repercussions when applying for relevant insurance products.

Another layer of legal protection comes from state laws, which vary considerably and can offer additional safeguards against discrimination based on genetic information within life insurance. Some states have implemented measures that limit insurers’ ability to request genetic tests, while others mandate that individuals cannot be discriminated against based solely on genetic information. However, these state laws often do not align uniformly, leading to a patchwork of protections that may inadequately cover all individuals.

In conclusion, while significant strides have been made in protecting individuals from discrimination based on genetic testing, especially under GINA, critical gaps remain, particularly in the context of life insurance. The interplay between genetic testing and insurance premiums continues to evoke important conversations regarding privacy and the ethical implications of utilizing genetic information in insurance underwriting processes.

The Ethical Dilemma: Balancing Risk and Privacy

The integration of genetic testing into life insurance policies raises profound ethical dilemmas, principally concerning the balance between individual privacy and the necessity for insurance companies to assess risk accurately. Proponents of utilizing genetic data argue that it equips insurers with valuable insights into an individual’s health risks, thereby allowing for more precise premium pricing. By understanding genetic predispositions, insurance providers can tailor policies that reflect the risk levels associated with potential medical conditions, ultimately leading to a more sustainable insurance model.

However, the reliance on genetic testing brings forth significant privacy concerns. Many argue that such practices intrude on an individual’s right to confidentiality regarding their personal health information. The transmission of genetic data can lead to unintended consequences, such as discriminatory practices, where individuals with specific genetic markers may be unfairly penalized with higher premiums or even denied coverage altogether. This raises the question of fairness and equality in access to insurance, as those with unfavorable genetic profiles may face dire financial consequences simply based on their genetic makeup.

In examining the ethical implications, one must also consider various ethical theories. Utilitarian perspectives might suggest that the benefits of enhanced risk assessment for the overall insurance pool could outweigh potential privacy invasions. Conversely, a Kantian approach would vehemently oppose such practices, emphasizing the intrinsic value of treating individuals as ends in themselves rather than as mere means to an organizational goal. This ethical tension illustrates the complex interplay between the financial imperatives of life insurance companies and the fundamental rights of individuals to maintain their privacy, highlighting the underlying need for comprehensive regulation in the realm of genetic testing and life insurance.

Consumer Perspectives and Experiences

The intersection of genetic testing and life insurance has become a pivotal topic of discussion among consumers, drawing attention to how individuals perceive the sharing of their genetic information. Recent surveys highlight a significant divide in consumer attitudes towards genetic testing when it relates to life insurance. While some individuals express a willingness to undergo testing for potential benefits, such as cheaper premiums, many others voice serious concerns about privacy.

Among those who are hesitant, fears of discrimination loom large. These consumers often worry that insurers could unfairly use genetic information to inflate premiums or deny coverage altogether. For instance, a survey from a leading insurance advocacy group revealed that approximately 60% of respondents felt uneasy about the possibility of their genetic predispositions impacting their insurance rates. This sentiment is underscored by case studies of individuals who experienced negative consequences after disclosing their genetic information, which has contributed to a broader narrative advocating for consumer protection in the realm of genetic data accessibility.

Conversely, a segment of consumers recognizes the potential financial advantages of sharing their genetic data. Some individuals reported that their life insurance premiums decreased after they opted for genetic testing, which led insurers to assess their health risks more favorably. Personal narratives from these consumers reflect a nuanced understanding of the trade-offs between privacy and cost savings; they often articulate a calculated approach to weighing the benefits against potential risks.

This duality in consumer experiences provides essential insight into the ongoing debate surrounding genetic testing and life insurance: privacy vs. premiums. While personal narratives illustrate the tension within these choices, they also signify the need for more transparent policies that address both the ethical implications and the financial realities of insurance practices utilizing genetic information.

Future Trends in Genetic Testing and Insurance

The relationship between genetic testing and life insurance is evolving rapidly, driven by technological advancements and changing consumer attitudes. As emerging technologies like artificial intelligence and machine learning become more integrated into the insurance sector, they are likely to enhance underwriting processes and risk assessments through more detailed analyses of genetic predispositions. These innovations can potentially lead to more personalized insurance products, where premiums are calculated not only based on traditional risk factors but also on genetic markers indicative of health risks.

Moreover, there is a notable shift in how consumers perceive genetic information and its implications for life insurance. As the general public grows more educated about genomics and the benefits of genetic testing, it stands to reason that demand for personalized insurance solutions may increase. Insurers that adapt to this trend will likely need to consider consumer preferences regarding the use of genetic data while addressing privacy concerns. This balancing act is crucial, as any perceived misuse of genetic information could drive consumers away from companies that do not prioritize their privacy.

Legislators also play a pivotal role in shaping the landscape of genetic testing and life insurance. Potential regulations aimed at protecting consumers from genetic discrimination could impact how insurers utilize genetic information in underwriting. Companies may need to stay ahead of legislative changes to ensure compliance and trust amongst policyholders. Furthermore, as personalized medicine continues to gain traction, its integration into life insurance practices will require insurers to reassess their traditional models of risk evaluation.

In summary, the future of genetic testing and life insurance appears to be one of increased personalization, enhanced technological integration, and more stringent privacy considerations. Future developments will undoubtedly reshape the industry, necessitating an adaptive approach that meets both consumer needs and regulatory requirements.

Conclusion and Takeaways

As we navigate the complexities surrounding genetic testing and life insurance: privacy vs. premiums, it becomes increasingly evident that a delicate balance is necessary. This discussion has illuminated the various facets of how genetic information can significantly influence life insurance premiums, prompting the need for precision in risk assessment. Insurers often assert that knowledge of an individual’s genetic predisposition can enhance their ability to evaluate risk, ultimately leading to more personalized policies. However, this practice raises substantial concerns regarding privacy and the potential for discrimination.

Throughout this blog post, we have examined the ethical implications of utilizing genetic data in the underwriting process. One key takeaway is that while genetic testing can provide invaluable insights into an individual’s health risks, insurers must be cautious and proactive in safeguarding applicants’ sensitive information. The potential misuse of genetic data could lead to unjust premium rates based on predispositions rather than actual health conditions. Hence, it is imperative for both professionals and consumers to advocate for regulations that protect privacy without compromising the integrity of risk evaluation.

Furthermore, this dialogue urges readers to reflect on their personal views regarding the intersection of genetic testing and the life insurance industry. How do you prioritize privacy against the demands of accurate risk assessment? Staying informed on the evolving landscape of genetic testing and insurance practices is essential for making educated decisions. As advancements in genetic science occur, the conversation surrounding privacy and premiums will undoubtedly evolve, necessitating ongoing discourse among stakeholders. Engaging in this dialogue will help foster a more equitable environment that respects individual privacy while ensuring the financial sustainability of life insurance products.